Real Estate Transfer Tax In Ct . real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. So, for a house worth $410,357 — the median home price in the state —. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. residents of connecticut can also use their transfer tax to reduce their income or property tax if they paid any transfer tax.

from www.formsbank.com

So, for a house worth $410,357 — the median home price in the state —. residents of connecticut can also use their transfer tax to reduce their income or property tax if they paid any transfer tax. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100.

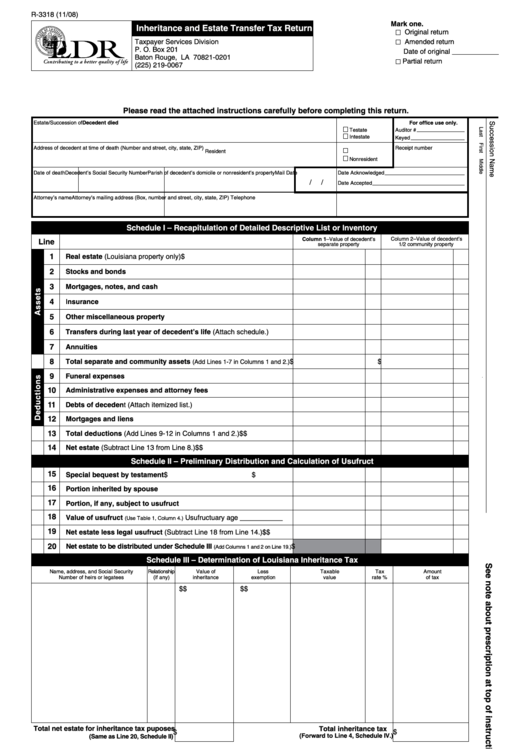

Fillable Inheritance And Estate Transfer Tax Return printable pdf download

Real Estate Transfer Tax In Ct real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. residents of connecticut can also use their transfer tax to reduce their income or property tax if they paid any transfer tax. So, for a house worth $410,357 — the median home price in the state —. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100.

From templates.legal

Connecticut Deed Forms & Templates (Free) [Word, PDF, ODT] Real Estate Transfer Tax In Ct connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. residents. Real Estate Transfer Tax In Ct.

From www.formsbank.com

Fillable Inheritance And Estate Transfer Tax Return printable pdf download Real Estate Transfer Tax In Ct So, for a house worth $410,357 — the median home price in the state —. real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. residents of connecticut can also use their transfer tax to reduce their income or property tax if they paid any transfer tax. in connecticut,. Real Estate Transfer Tax In Ct.

From exojyvgpm.blob.core.windows.net

How To Transfer Property In New York State at Luz Searles blog Real Estate Transfer Tax In Ct real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the. Real Estate Transfer Tax In Ct.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Real Estate Transfer Tax In Ct residents of connecticut can also use their transfer tax to reduce their income or property tax if they paid any transfer tax. So, for a house worth $410,357 — the median home price in the state —. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut's. Real Estate Transfer Tax In Ct.

From gioneqjht.blob.core.windows.net

Lowest Real Estate Taxes In Connecticut at Dean Gomez blog Real Estate Transfer Tax In Ct in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. So, for a house worth $410,357 — the median home price in the state —. real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. . Real Estate Transfer Tax In Ct.

From www.cga.ct.gov

Connecticut's Tax System Staff Briefing Real Estate Transfer Tax In Ct So, for a house worth $410,357 — the median home price in the state —. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. residents of connecticut can. Real Estate Transfer Tax In Ct.

From dxoluqmio.blob.core.windows.net

Real Estate Transfers Charleston Sc at Michael Hilson blog Real Estate Transfer Tax In Ct connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. So, for a house worth $410,357 — the median home price in the state —. residents of connecticut can also use their transfer tax to reduce. Real Estate Transfer Tax In Ct.

From www.ownerly.com

How to Calculate Property Tax Ownerly Real Estate Transfer Tax In Ct connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. So, for a house worth $410,357 — the median home price in the state —. residents of connecticut can. Real Estate Transfer Tax In Ct.

From www.forbes.com

What Are Real Estate Transfer Taxes? Forbes Advisor Real Estate Transfer Tax In Ct real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. residents of connecticut can also use their. Real Estate Transfer Tax In Ct.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go Real Estate Transfer Tax In Ct So, for a house worth $410,357 — the median home price in the state —. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. residents of connecticut can. Real Estate Transfer Tax In Ct.

From formspal.com

Real Estate Transfer Declaration PDF Form FormsPal Real Estate Transfer Tax In Ct connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. So, for a house worth $410,357 — the median home price in the state —.. Real Estate Transfer Tax In Ct.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Real Estate Transfer Tax In Ct connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. So, for a house worth $410,357 — the median home price in the state —. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. residents of connecticut can. Real Estate Transfer Tax In Ct.

From gioneqjht.blob.core.windows.net

Lowest Real Estate Taxes In Connecticut at Dean Gomez blog Real Estate Transfer Tax In Ct connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. So,. Real Estate Transfer Tax In Ct.

From suburbs101.com

Connecticut Real Estate Transfer Tax Calculator 2023 Suburbs 101 Real Estate Transfer Tax In Ct connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. So, for a house worth $410,357 — the median home price in the state —. real estate transfer taxes are fees imposed by the state, county,. Real Estate Transfer Tax In Ct.

From www.linkedin.com

How High Are Connecticut's Estate Tax Rates in 2024? Olivia Barham Real Estate Transfer Tax In Ct So, for a house worth $410,357 — the median home price in the state —. connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. real estate transfer taxes are fees imposed by the state, county,. Real Estate Transfer Tax In Ct.

From listwithclever.com

What Are Transfer Taxes? Real Estate Transfer Tax In Ct connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. So, for a house worth $410,357 — the median home price in the state —. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. connecticut also imposes a 1.11% controlling. Real Estate Transfer Tax In Ct.

From exolmrblx.blob.core.windows.net

Real Estate Agent File Taxes at Aaron McCarty blog Real Estate Transfer Tax In Ct connecticut's current transfer tax rate is usually $0.75 to $2.25 per $100. in connecticut, the real estate conveyance tax is.0075 of every dollar to the state (thts 3/4 of 1%) and.0050 of every dollar to the. real estate transfer taxes are fees imposed by the state, county, or city when property ownership changes hands. connecticut also. Real Estate Transfer Tax In Ct.

From www.cbpp.org

State “Mansion Taxes” on Very Expensive Homes Center on Budget and Real Estate Transfer Tax In Ct connecticut also imposes a 1.11% controlling interest transfer tax on real estate transferred through the sale or transfer of. residents of connecticut can also use their transfer tax to reduce their income or property tax if they paid any transfer tax. real estate transfer taxes are fees imposed by the state, county, or city when property ownership. Real Estate Transfer Tax In Ct.